December 17, 2020 by Ron Lesh (BGL)

This has been a tumultuous year for BGL, our clients and the superannuation industry.

During the year, the government introduced another super early release scheme – this time in response to COVID-19.

I have asked our friends at mProjections to do a couple of calculations to demonstrate the impact of a withdrawal and how to engineer a higher retirement. Please check these out.

Example 1

Phillippa, 29, worked in the hospitality industry with 2 jobs, total income (pre Covid) of around $55,000pa, pre-tax. She is single and had built up a Super balance of $25,000.

Shortly after loosing one of those jobs, she withdrew $8,000 without thinking about the consequences to super. Her Super had been invested in a typical ‘Balanced’ Investment Option with 65% in growth assets.

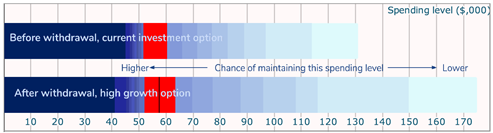

Using the mProjections Report, Philippa moved her post-withdrawal balance to a High Growth Investment Option (85% in growth assets). She saw that, before withdrawal, she would have $55,194 pa annual retirement income for 25 years, but with a move to High-Growth – without additional contributions – she would enjoy a $57,415 projection. Most importantly, her upside for a considerable improvement in retirement spending would increase.

Example 2

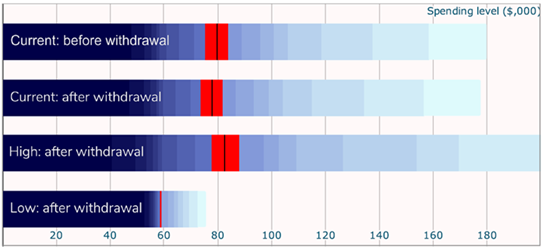

Jonathan works as an electrician in the western suburbs of Sydney and had his hours reduced to 20 hours per week for 3 months. He decided to withdraw $8,500. Using figures in our Report, he saw how to increase his $79,747 tax-free pre-withdrawal retirement projection by moving the balance of his fund to a High Growth Investment Option and a consequent retirement income projection of $82,442.

He also noted the greater likelihood of upside. ‘Low’ here is 15% of assets in growth.

If you would like to prepare an mProjections report for your clients, check out their website.