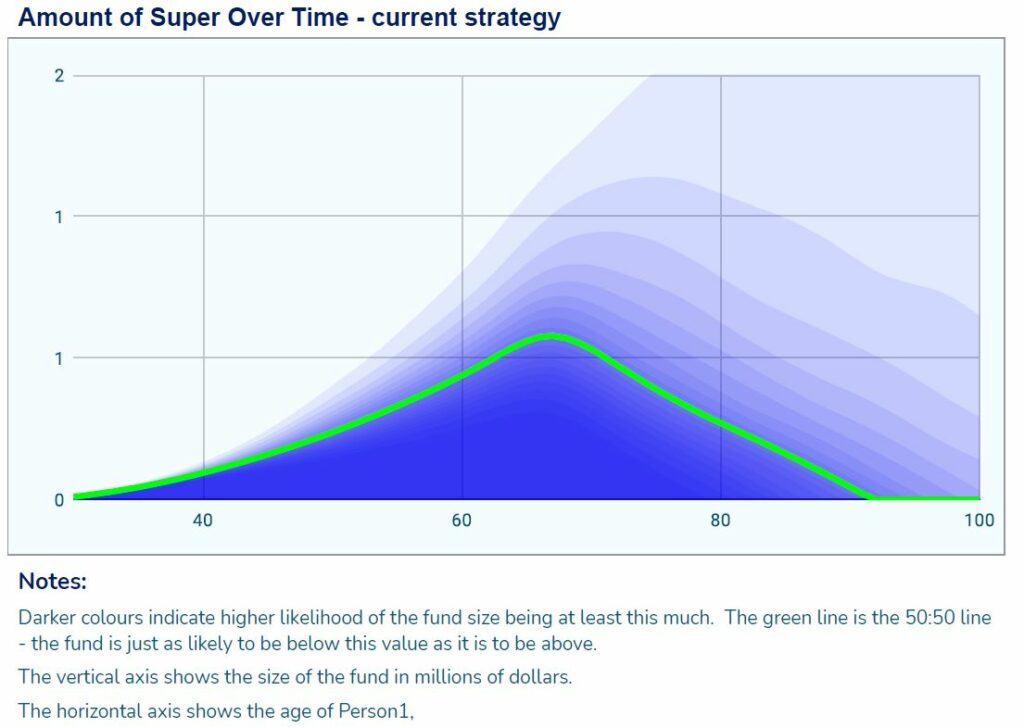

Page 4 shows us the possible amounts in the Fund from now to age 100. The amount invested in an SMSF generally increases as one approaches retirement due to continuing contributions and the returns from investments. As investment returns are uncertain, this chart shows the most likely values (dark colours) and the less likely (lighter colours).