Retirement Income Strategy

The Australian Government (see here) is proposing that from 1 July 2022 all public offer super funds (those that anybody can join) must have a documented Retirement Income Strategy for retired members, or those approaching retirement. This is not required for Self-Managed Superannuation Fund (SMSF) but it is something that should be seriously thought about, because the process of drawing down money from the SMSF for living expenses in retirement is what an SMSF is all about.

The aim of the strategy is to assist the SMSF members:

- maximise their retirement income, taking into account the Age Pension;

- manage risks to the stability and sustainability of their income;

- have some flexible access to savings in retirement.

In this section we assist SMSF members to be informed on possible retirement scenarios so they can come up with a sensible Retirement Income Strategy. We base this process on our Investment Options Report. If you haven’t already seen one of these, you can read about them here, or go straight to the questionnaire to produce one.

If you’re not yet a subscriber you can read the process below and then join us by clicking on the button:

Using this document

To understand why you need a Retirement Income Strategy we give the background here.

A significant component of a retirement income strategy is the asset allocation, which has to be chosen by the Trustees – see here.

Our Retirement Options Report will help in the choice, so we describe how that works here.

Then some decisions need to be made, that we talk about here …

… and we give you a checklist if you’re ready to go!

Background

Proposed superannuation regulations (see here) will require public offer funds to have a Retirement Income Strategy that outlines their plan to assist their members to achieve and balance the following objectives:

- maximise their retirement income

- manage risks to the sustainability and stability of their retirement income; and

- have some flexible access to savings during retirement.

While SMSF trustees don’t have to produce such a strategy, the way a fund is used for living expenses in retirement is an important part of any SMSF’s ongoing management. For this reason it would be a good idea for members of the SMSF to go through the process that would be necessary to produce a strategy.

This retirement income strategy process should assist in meeting these requirements.

One major principle behind the superannuation system is that it is for the purpose of providing a higher standard of living in retirement than would otherwise be obtained. It is not meant to be passed on to children or other heirs. The Government’s position is that the retirement income strategy is not meant to help provide a bequest. This means that assets will gradually need to be liquidated over time. This is automatically taken into account in our calculations.

Trustees should also specify how regularly they will review the strategy and how they will implement it, similar to how public offer funds will be required to do.

The legislation does not prescribe what time period constitutes “regularly” reviewing a retirement income strategy. Because of its nature, this strategy will not need to be reviewed at the same frequency as the investment strategy that SMSFs do need to produce. An mProjections subscription makes this review process easy and cost effective, alongside the regular monitoring of the fund’s performance and review of the investment strategy, so consider if this document could be reviewed, updated if necessary, signed and filed on an annual basis as part of the investment strategy.

The Retirement Income Strategy

A retirement income strategy is meant to maximise retirement income taking into consideration the stability and sustainability of that income.

Retirement involves multiple decisions and difficult trade-offs, such as:

- when to retire

- how to invest their SMSF

- how to draw down their savings

- whether to buy an annuity; and

- their future expenditure and capital needs.

An important part of the strategy is how to invest the SMSF. This will be a key component of the investment strategy that SMSFs are already required to have. Trustees should ensure that the two strategy documents are aligned.

Our Retirement Options report is the main tool that we’ll use to consider what may be an appropriate retirement income strategy. The Report has charts that show likelihoods of maintaining different spending levels that could arise when a Member enters retirement. It also shows fund values as time goes by, and comparatives of different Investment Strategies. More than 10 decisions concerning superannuation and non-superannuation investments can be modelled.

The next section walks you through an example of how to use the Investment Options Report to help you decide on an appropriate retirement income strategy. It is based on a couple, Pat and Sam, who are approaching retirement, both aged 65, expecting to retire at age 67, who own their own home. One of them has $500,000 in their SMSF, the other has $200,000.

Determining a Retirement Income Strategy

The first thing Pat and Sam (the couple we mentioned immediately above) need to do is to run an Investment Options Report. Additional information we need to specify is that the first person, Pat, is still making contributions of $10,000 per annum to their SMSF, with no additional contributions. Their partner, Sam, is not contributing to the fund.

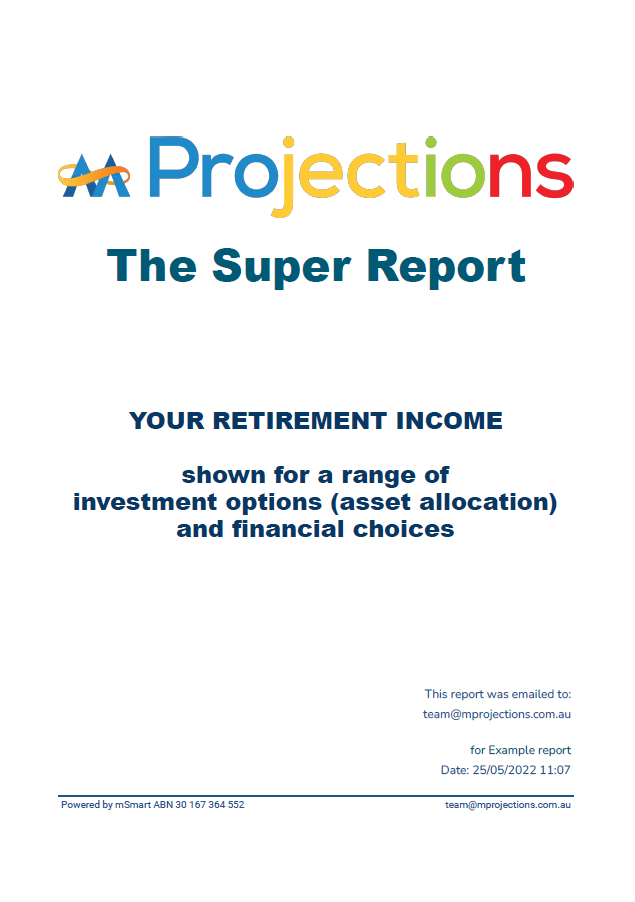

In this base case an income of $71,000 has a 50:50 chance of lasting for 25 years in retirement to age 92. The lighter colours in the right of the bar indicate, for example, that incomes above about $80,000 (lightest blue) have less than 10% chance of being sustained to age 92.

The darkest blue on the left indicate that incomes of less than $57,000 have at least a 95% chance of lasting to age 92.

Asset Allocation

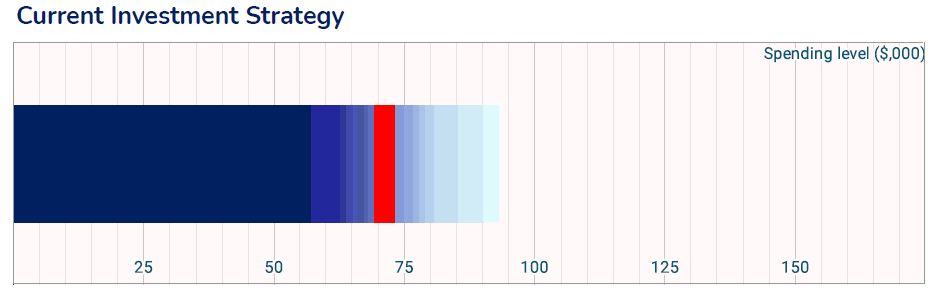

How the asset allocations affect the likely retirement spending levels after retirement is shown in the next chart. The asset allocation is very important as we see in the next series of charts where we change the asset allocation to be:

- The current asset allocation

- five asset allocations with Growth assets varying between 85% to 25% (equities and similar assets), and

- a Lifecycle asset allocation that starts at 65% in Growth assets at age 65, declining to 40% as the person gradually ages.

This chart shows the range of possible annual spending levels (ie, annual ‘income’; ‘retirement spending’) and the probability of the retirement spending running out before the first 25 years of retirement. When these forecasts are considered, it is important to look at the range of possible outcomes as well as the forecast outcome. This is because investment markets can go down at the most inconvenient time.

While we calculate all values to many decimal places, we know that any number we produce is only an estimate of the future. To reduce the idea of false accuracy we round all numbers in this discussion to the nearest thousand dollars. This is required by regulation.

Pat and Sam (classed as a couple for pension purposes) have assets worth $500,000 and $200,000, respectively, in their fund. They are approaching retirement, both aged 65, expecting to retire at age 67; they own their own home. Pat is still contributing $10,000 p.a. to the super fund, which has 65% in Growth assets.

They want to have a steady income for 25 years in retirement, to age 92. After their Fund has been exhausted their total income will come from the Age Pension.

Spending level is determined by the total of dividends, interest, capital and age pension and is calculated to comply with current tax and age pension legislation and in today’s dollars.

As retirement spending levels increase in this chart, the chance that the Fund will run out at an earlier than 25 years increases. A lower forecast spending has a lower chance of running out. The red line shows a 50:50 chance.

In thinking about the charts, it should be noted how the forecasts show a lower median spending level and a narrowing of the range of outcomes as the asset allocation becomes more committed to ‘defensive’ assets. As a Fund adds to its proportion of ‘defensive’ assets (cash, fixed interest) the spending level will need to be decreased to reduce the chance of it running out earlier than desired. On the other hand, the possibility of having to reduce it to a very low level is also reduced.

As the allocation to growth assets increases, not only does the forecast cashflow in retirement increase (generally speaking), but so does the range of possible outcomes. Whilst it is tempting simply to choose the Strategy with the highest possible cashflow, this needs to be assessed carefully.

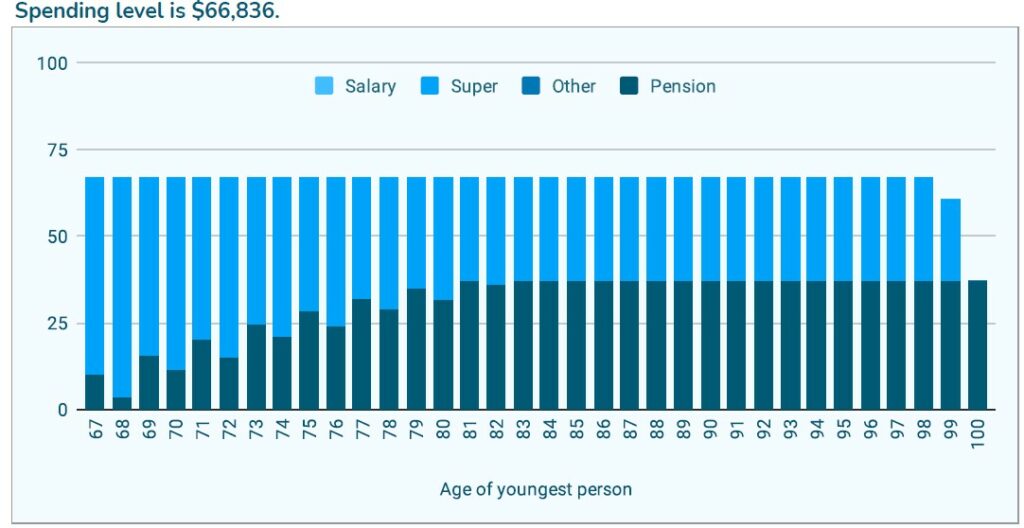

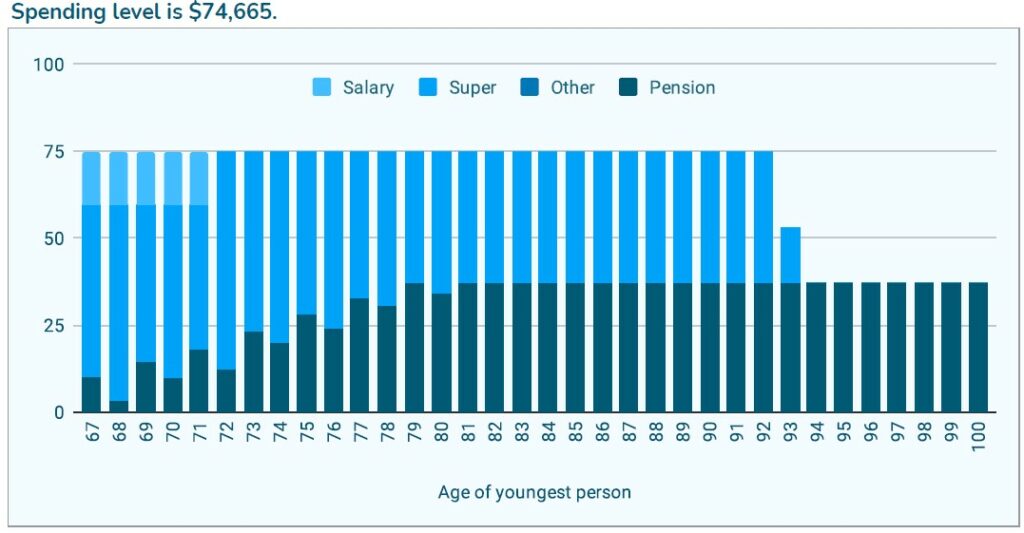

An indication of the sources for an income of $71,000, for example, when there is the average level of asset returns over time, with a typical level of volatility (half the time markets go up, half the time they go down but by less than they go up), is in the chart on the right. The Base Case has payments being made from the superannuation fund in the early years of retirement (lighter blue), and with pension payments (darker blue) increasing as the assets decline to a level below the pension assets test.

After 25 years the super fund has been exhausted and all income for Pat and Sam’s late 90s is gained from the Age Pension.

Delay retirement?

By delaying retirement the spending level would increase. This is because retiring later allows an SMSF to accumulate more assets over the additional period of working and contributing to the Fund.

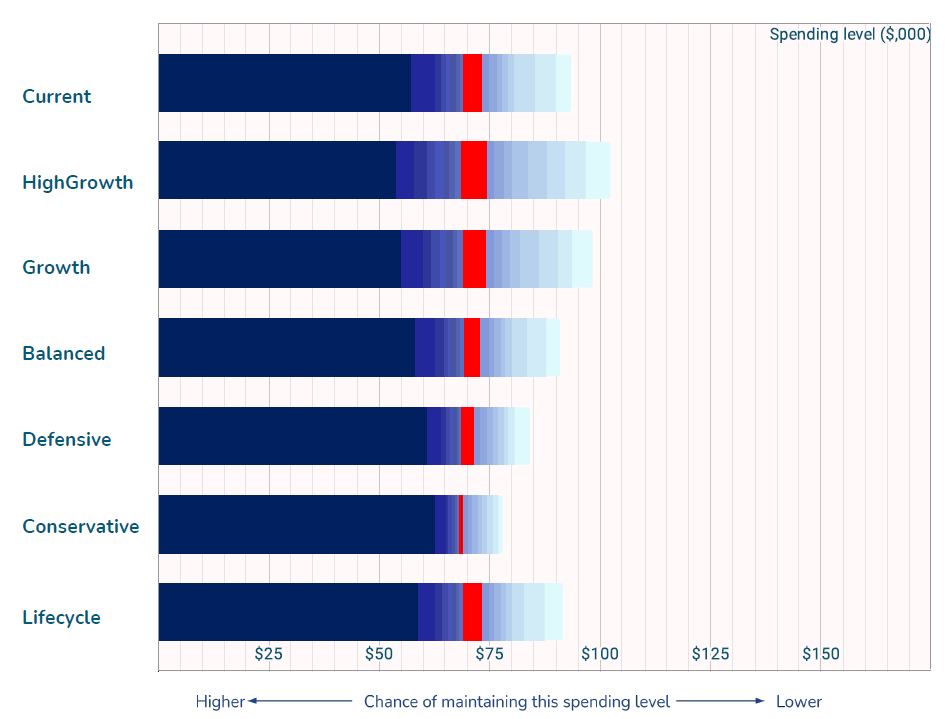

What happens to Pat and Sam when they decide to change their retirement age to 70, a delay of 3 years? Let’s assume that they will still want their SMSF to last till they reach the age of 92. They run a report with the new retirement age.

The chart on the left shows the range of possible incomes for this case compared to the Base Case. There is a significant increase in the income with a 50:50 chance of lasting till age 92, to $80,000 from $71,000. The upside has also increased substantially (lightest blues). The level of income that has a 95% of lasting till 92 has also increased, though only slightly.

As another wrinkle to consider, what if Pat and Sam want to retire later, but still want their SMSF to last for 25 years, now to age 95 rather than 92? We can do that easily, finding that the 50:50 income level now comes at a level of $74,000.

Longevity risk

What happens if Pat and Sam are worried about their SMSF running out while they find they’re hale and hearty at age 92? The technical term for this is longevity risk – the possibility that you live longer than expected.

We’ve already looked at one way of managing this – an annual income of $57,000 has a 95% chance of lasting till age 92, compared to the 50% chance of $71,000 lasting that length of time.

Another approach is to consider the income that would have a 50:50 chance of lasting 30 years instead of 25 years. This goal requires the spending level to be reduced to $67,000.

Annuities

Another way of handling the risk of living longer than expected is to purchase an annuity, which gives greater certainty on the income in retirement later in life. There are many types of annuities on the market with different bells and whistles attached to them. Our model takes one of these approaches to show the effect of an annuity bought by one or other of the people in the SMSF.

Extra Income

Some people want to continue some part-time work when they retire. Pat and Sam are the same. They believe that they’ll be able to earn $15,000 a year for their first 5 years in retirement.

Entering this information into the questionnaire we find that the steady level of income for 25 years goes up to $75,000. The extra income for the first 5 years means that they don’t need to draw down as much on their super, which allows them to be invested for longer, giving more available assets to draw down later.

Deciding what to do

After going through an exercise similar to that described, Pat and Sam must come to a decision over what their strategy will be, and then they must ensure the strategy is acted upon.

But first, we must make sure they understand an important concept. In the discussion above there is talk of such things as an income of $75,000 being in place for 25 years, with a constant asset allocation over that time. These settings are not carved in stone – they are meant to be reviewed and adjusted as necessary to meet changing conditions and members’ expectations.

The point of the projection exercise is to ensure that the current position of the SMSF, and for the next couple of years, is consistent with Members’ longer term expectations. Let’s look at two examples to show this.

Pat and Sam might like to spend more in the early years of their retirement, knowing that would lead to relying on the age pension at an earlier age than the Base Case considered above. To understand some of the implications of this, they run an Investment Options Report where they ask that their income be set for 15 years instead of 25, in other words a 50:50 chance of lasting till age 82 after retiring at 67.

This report shows them that a spending level of $92,000 would have a 50:50 chance of running out before age 82, which is an increase of $17,000 per year.

On the other hand, they might be worried about their money running out and having to rely only on the age pension. In that case we know from the Base Case analysis above that an income of $57,000 has a very good chance of lasting till age 92, and, looking at the case where a period of 30 years in retirement was considered, a slightly lower income of $54,000 has a very good chance of reaching age 97.

The important thing is that when they start out with a high, medium, or low income, they do not have to stay at that level. When they review their Retirement Income Strategy (remember that regular review is what we recommend) Pat and Sam may decide that, in the light of experience, their preferences have changed.

While considering matters such as retirement date, longevity, extra income and the like, Pat and Sam should remember that their Investment Strategy is not set in concrete. It may be that in thinking about these matters they could decide that more growth assets would be better, or possibly being more defensive in asset allocation. Each report they produce allows some consideration of these matters.

Checklist

Being methodical is something that you know is necessary for running an SMSF, so here is a suggested list of steps to go through using our Investment Options Report:

- What is a suitable asset allocation to use as a Base Case for your analysis? If you already have an Investment Strategy then use that, otherwise you may wish to go to our Investment Strategy page to help you decide. Or, to start the process, stick with the default that we have – your subscription allows you to run as many reports as you need if you later decide to change this.

- At what age should you retire? Check at least 2 ages to see how significant a difference it can make.

- How long do you want the income to last before reverting to only the aged pension as income? Our default is 25 years after retirement.

- Are you anticipating any additional income in retirement? This will reduce the need to draw on your SMSF, but also reduces any part pension you may receive.

You don’t have to make a decision on these matters in a rushed fashion. The default assumptions we make will give an indication of what chance there is that a particular level of income will last 25 years in retirement. So unless you’re currently spending an amount that will likely not reach age 92 you can make your decision in a slow and thoughtful manner.

If you don’t already have a subscription, use the button to take control of your super!

Photos by Josh Hild , Karolina Grabowska, Alena Darmel from Pexels, Yan Krukov from Pexels, Anastasia Shuraeva from Pexels